Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links. This article is meant for information purposes only and doesn’t constitute personal finance, legal, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Last week, I wrote about two amazing hotel credit card offers, offering 5 free hotel nights with each welcome bonus. I was poking around on the Amex website and found that I was able to pull up a 150,000 points offer on the Business Platinum card while using a referral link. Please note that sometimes these offers can be a bit YMMV. I was also able to pull up a 90,000 points welcome bonus offer on the Business Gold card as well.

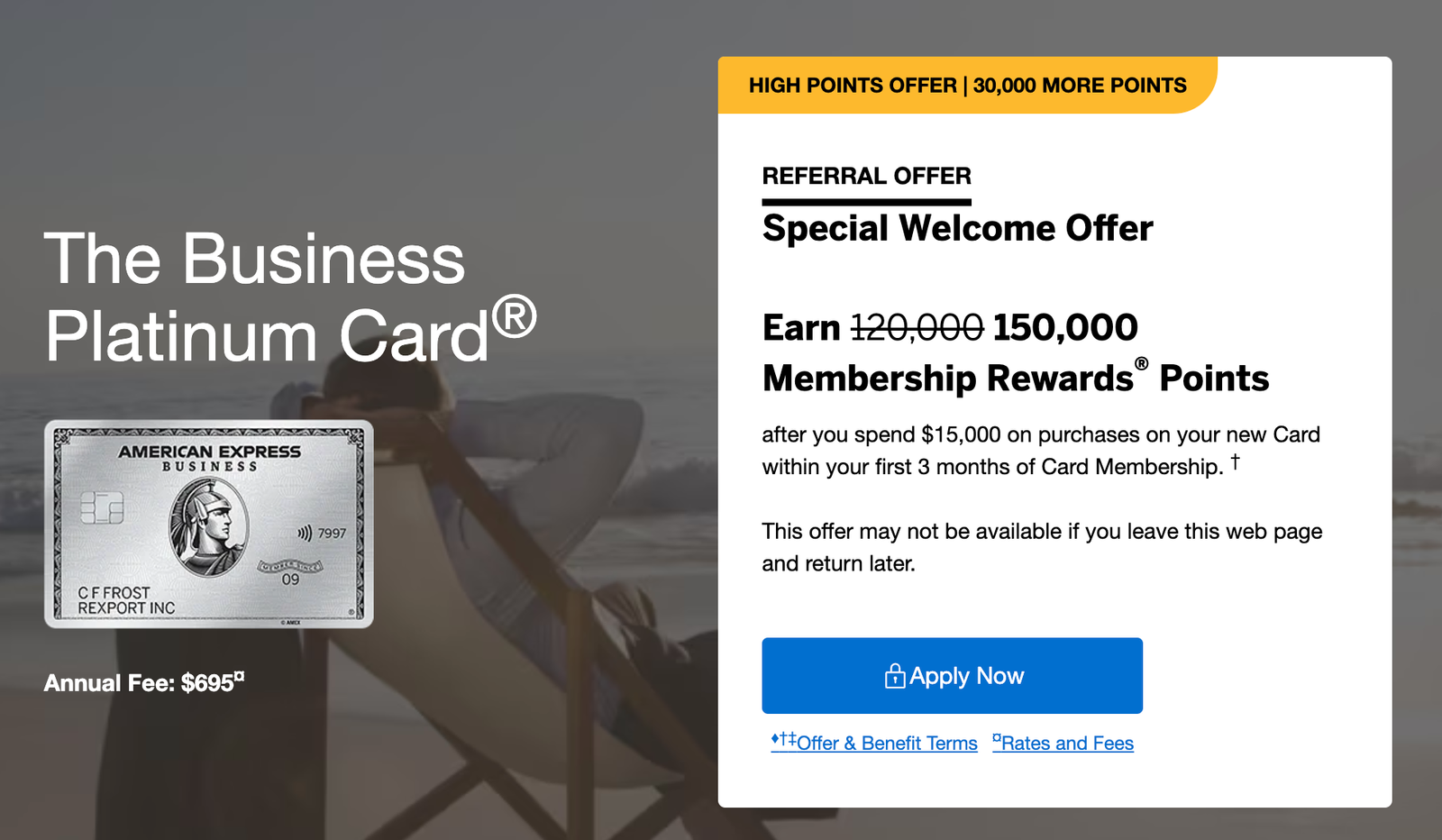

Business Platinum Card Offer

I was able to open the link in Chrome browser while in incognito mode and access these elevated offers. If you’re still not able to access these better offers, you can try clearing your cookies, browser history and give it a shot once again. Also, you may try a different browser or a VPN if nothing works. In my case, the offer showed up right away in Chrome incognito mode.

Offer Details

With this offer on the Business Platinum card, you’ll earn a welcome bonus of 150,000 Membership Rewards points after you spend $15,000 in the first 3 months of card membership.

T&Cs of the 150,000 points offer

You can refer to this post for a review of this card and how you can maximize the bonus and credits in the first year of card membership. Please note that Amex’s welcome bonus restrictions do apply to this offer. You may not be eligible to receive a welcome offer if you have or have had this Card or previous versions of this Card. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Even if you’re not sure about keeping the card long term, the 150,000 Membership Rewards points bonus can go a long way in helping you book your next flight or hotel stay. In my opinion, I still feel that Amex has the most variety when it comes to airline transfer partners.

I’ve derived a great deal of value by booking flights on Star Alliance partners by transferring my points to Avianca LifeMiles and Air Canada Aeroplan. Moreover, Amex runs transfer bonuses every now and then. You can maximize these transfer bonuses by transferring points to Hilton Honors (often at a 1:2.6 ratio instead of the standard 1:2) and get the fifth night free while booking with points.

Even if you choose to cancel the card after the first year, you can double dip on many of the credits in the first card membership year. That way, you’ll still extract a significant amount of value from the card in the form of these credits, more than enough to pay for the steep $695 annual fee.

The Pundit’s Mantra

In my experience, I’ve found the 35% airline bonus to be the most valuable feature of this card. I can simply book any first class or business class flight using Pay with Points and then get 35% of the points reimbursed. Moreover, these flights are treated as cash tickets so you can also earn airline miles and elite credits on these flights. Which is your favorite feature of the Business Platinum card? Tell us in the comments section.

Never miss out on the deals, news and travel industry trends. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content! You have Successfully Subscribed!